The case of a client's credit card debt of 8 million escalating to 8 billion over 11 years at Eximbank has recently attracted the attention of media agencies, press, and legal professionals. Currently, Eximbank has issued an official statement regarding the matter, acknowledging that the previously used interest calculation method was inappropriate and will take steps to resolve the issue with the client to ensure a balanced outcome for all parties. Additionally, numerous articles have discussed Eximbank's use of compound interest calculation on credit card loans and provided detailed analyses of this method.

Following this case, many clients have expressed their concerns and worries to ATA Global Legal Limited Company. Among their primary concerns is whether the bank's practice of compound interest calculation on credit card loans is correct and how to determine if the bank is applying compound interest to their accounts.

To shed light on these legal issues, we interviewed Ms. Nguyen Thi Ngoc Anh – Managing Lawyer and Director of ATA Global Legal Limited Company.

Ms. Nguyen Thi Ngoc Anh - Director, Managing Lawyer of ATA Global Legal Limited Company

1. Regarding the Eximbank case and its clients, what is your assessment of Eximbank's method of calculating credit card debt interest?

In principle, clients owe banks or use credit cards from any bank must repay both the principal and interest. If clients violate the obligation to repay the principal and interest, they may also incur overdue interest, late payment interest, penalty fees, and other charges as stipulated in the credit agreement. Regarding the calculation of overdue interest and late payment interest, as reported by news outlets, banks typically use two methods: (i) based on the outstanding principal balance; and (ii) based on the consolidated balance (also known as compound interest). With the compound interest calculation method, if clients fail to fully repay the accrued interest and late payment interest, all these amounts will be added to the outstanding balance to calculate interest for the next period. This calculation method causes the client's outstanding balance to rapidly increase, as seen in the recent case of Eximbank.

Although Eximbank's compound interest calculation method and those of other banks may not violate legal regulations, they are highly disadvantageous to clients. Essentially, the bank only extends one principal loan, but with this method, the outstanding balance used to calculate interest continuously increases, resulting in accumulating interest. Furthermore, once interest is compounded, it generates additional interest, late payment interest, penalty fees, and other charges, perpetuating a cycle of debt.

2. As you mentioned, the compound interest calculation method is not in violation of legal regulations. Could you elaborate on this issue?

Currently, the State Bank of Vietnam has issued Circular 14/2017/TT-NHNN on the method of interest calculation in deposit-taking and lending activities between credit institutions and clients.

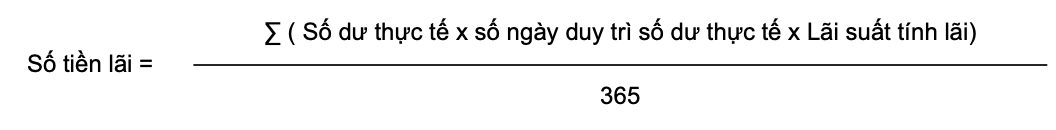

According to Circular 14, the amount of interest arising from client loans is determined by the following formula:

Accordingly, the Actual Balance is the beginning-of-day balance used to calculate interest on the outstanding principal balance within the term, outstanding principal balance overdue, actual late payment interest balance that the credit recipient still needs to repay to the credit grantor, as agreed upon and prescribed by law.

Based on this regulation, it is evident that the law allows banks to use consolidated balances to calculate accruing interest.

3. So, how do banks typically regulate their interest calculation methods?

In practice, most banks incorporate provisions regarding interest calculation for accrued balances/debts on credit cards using the consolidated balance method into their card opening and usage agreements. Moreover, some banks stipulate that the credit card balance includes all amounts related to card usage (including but not limited to: principal debt, interest, late payment interest, penalty fees, and other charges) that have not been settled by the cardholder with the bank.

I cannot affirm that when banks include such provisions in their contracts, they always apply the consolidated balance method for interest calculation. Many banks claim to still apply the interest calculation method based on the outstanding principal balance. However, with contracts recording interest calculation according to the consolidated balance method, there may still be cases where compound interest is applied, similar to the situation faced by clients at Eximbank, which the clients themselves cannot control and entirely depend on the bank's policies at different times.

4. Currently, many clients are worried about compound interest and are considering closing all their credit cards. What advice do you have for clients on this matter?

We do not deny the benefits that credit cards bring to individuals and the economy. However, we advise clients to conduct thorough and cautious evaluations of their capital needs and financial capabilities before using credit cards or obtaining credit loans to avoid falling into situations of late payment or inability to repay debts.

Regarding the issue of compound interest, based on legal regulations concerning consumer rights protection, clients have the right to demand that the bank or its representatives provide comprehensive information related to credit cards, including information on how interest is determined. Therefore, clients can request the bank to clarify whether interest is determined based on the outstanding principal balance or the consolidated balance of the credit card, or request the provision of an illustrated table clearly explaining the method of determining interest arising from credit cards. clients can retain documentation demonstrating these clarifications from bank personnel to protect their rights in case of related incidents.

Yes, thank you!

Related to the Eximbank case and the clients' 8.8 billion VND debt, Ms. Nguyen Thi Ngoc Anh has also made comments and evaluations on the client information collection process, contract negotiation process, and resolution procedures for issues arising during the implementation of credit agreements (including credit card opening and usage contracts) within the internal system of banks. Details are posted on Tin Tuc newspaper (Vietnam News Agency) (https://baotintuc.vn/tai-chinh-ngan-hang/eximbank-va-khach-hang-no-the-88-ty-dong-mong-som-giai-quyet-dut-diem-vu-viec-20240320182622727.htm).

Comment: